2025 Sensor Fusion for Autonomous Navigation Systems: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Competitive Analysis, and Growth Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Sensor Fusion for Autonomous Navigation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary & Market Overview

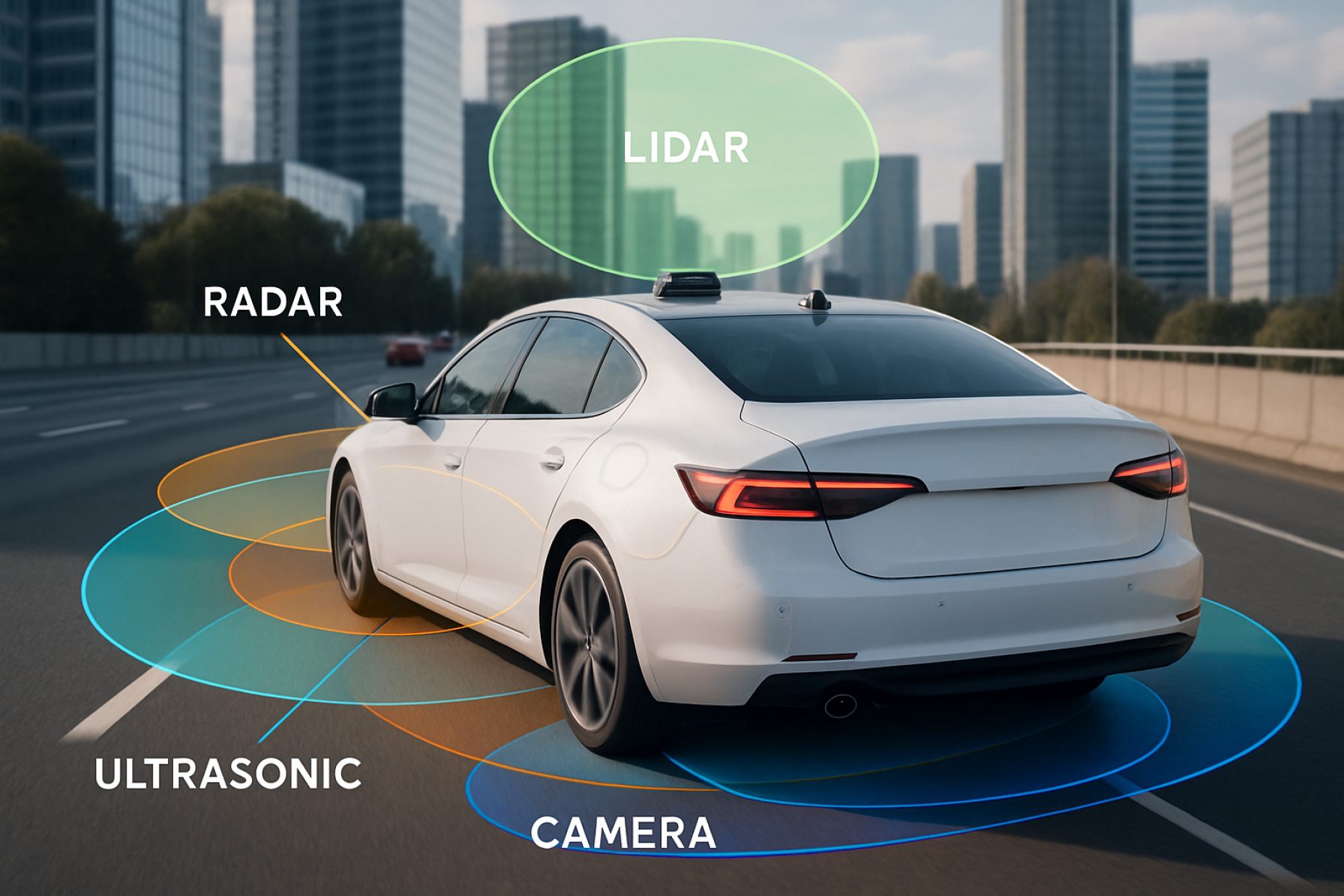

Sensor fusion for autonomous navigation systems refers to the integration of data from multiple sensor modalities—such as LiDAR, radar, cameras, ultrasonic sensors, and inertial measurement units (IMUs)—to enable robust perception, localization, and decision-making in autonomous vehicles and robotics. As of 2025, the global market for sensor fusion in autonomous navigation is experiencing rapid growth, driven by advancements in artificial intelligence, increased adoption of autonomous vehicles, and the proliferation of smart robotics across industries.

According to Gartner, the demand for sensor fusion technologies is being propelled by the need for higher safety standards, improved reliability, and the ability to operate in complex, dynamic environments. The automotive sector remains the largest consumer, with leading OEMs and technology providers integrating sophisticated sensor fusion algorithms to achieve SAE Level 3 and above autonomy. The market is also expanding into sectors such as logistics, agriculture, and defense, where autonomous navigation is critical for operational efficiency and safety.

A recent report by IDC estimates that the global sensor fusion market for autonomous navigation will surpass $8.5 billion by 2025, with a compound annual growth rate (CAGR) of over 18% from 2022 to 2025. This growth is underpinned by significant investments in R&D, strategic partnerships between sensor manufacturers and AI software firms, and regulatory support for autonomous mobility solutions.

- Key Market Drivers: The push for fully autonomous vehicles, advancements in sensor hardware (e.g., solid-state LiDAR, high-resolution radar), and the evolution of machine learning algorithms for real-time data fusion.

- Challenges: High system costs, sensor calibration complexities, and the need for robust performance in adverse weather and unstructured environments.

- Regional Trends: North America and Asia-Pacific lead in adoption, with Europe following closely due to strong regulatory frameworks and automotive innovation hubs.

Major industry players such as NVIDIA, Bosch Mobility, and Mobileye are at the forefront, offering integrated sensor fusion platforms that combine hardware and software for end-to-end autonomous navigation solutions. As the market matures, interoperability, standardization, and cybersecurity are emerging as critical focus areas for stakeholders.

Key Technology Trends in Sensor Fusion for Autonomous Navigation

Sensor fusion for autonomous navigation systems refers to the integration of data from multiple sensor modalities—such as LiDAR, radar, cameras, ultrasonic sensors, and inertial measurement units (IMUs)—to create a comprehensive and reliable perception of a vehicle’s environment. As the autonomous vehicle (AV) industry advances toward higher levels of automation, sensor fusion has become a cornerstone technology, enabling robust object detection, localization, and decision-making in complex and dynamic environments.

In 2025, several key technology trends are shaping the evolution of sensor fusion for autonomous navigation:

- AI-Driven Multi-Sensor Fusion: The adoption of deep learning and advanced AI algorithms is enhancing the ability to process and interpret heterogeneous sensor data in real time. Neural networks are increasingly used to fuse data at both the feature and decision levels, improving the system’s ability to handle sensor noise, occlusions, and adverse weather conditions. Companies like NVIDIA are leading the way with end-to-end AI-based sensor fusion platforms.

- Edge Computing and Real-Time Processing: The demand for low-latency perception and decision-making is driving the integration of high-performance edge computing hardware within vehicles. This allows for real-time sensor data fusion and reduces reliance on cloud connectivity, which is critical for safety and responsiveness. Intel and Qualcomm are investing heavily in automotive-grade processors optimized for sensor fusion workloads.

- Standardization and Interoperability: As sensor suites become more complex, industry consortia such as the SAE International and ETSI are working on standards for sensor data formats, interfaces, and fusion algorithms. This trend is expected to accelerate in 2025, facilitating easier integration and scalability across different vehicle platforms.

- Cost-Effective Sensor Architectures: Automakers are increasingly adopting sensor fusion strategies that optimize the trade-off between performance and cost. This includes the use of software-defined sensors and the selective deployment of high-cost sensors like LiDAR only where necessary, as seen in the approaches of Tesla and Toyota.

- Simulation and Digital Twin Validation: The use of simulation platforms and digital twins is becoming essential for validating sensor fusion algorithms under diverse scenarios. Companies such as ANSYS and dSPACE are providing advanced tools for virtual testing and validation.

These trends collectively underscore the rapid maturation of sensor fusion technologies, which are critical for achieving safe, reliable, and scalable autonomous navigation in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for sensor fusion in autonomous navigation systems is rapidly evolving, driven by advancements in artificial intelligence, sensor technology, and the growing demand for higher levels of vehicle autonomy. In 2025, the market is characterized by a mix of established automotive suppliers, technology giants, and innovative startups, each vying for leadership through proprietary algorithms, sensor integration expertise, and strategic partnerships.

Key players dominating the sensor fusion segment include Robert Bosch GmbH, Continental AG, and DENSO Corporation. These companies leverage their extensive experience in automotive electronics and deep integration with OEMs to deliver robust sensor fusion platforms that combine data from LiDAR, radar, cameras, and ultrasonic sensors. Their solutions are widely adopted in Level 2+ and Level 3 autonomous vehicles, with ongoing R&D investments aimed at enabling full Level 4 autonomy.

Technology firms such as NVIDIA Corporation and Intel Corporation (through its subsidiary Mobileye) are also prominent, offering high-performance computing platforms and advanced perception software. NVIDIA’s DRIVE platform, for example, integrates deep learning-based sensor fusion, enabling real-time processing of multi-modal sensor data for precise localization and object detection. Mobileye’s REM (Road Experience Management) technology leverages crowdsourced data and sensor fusion to enhance mapping and situational awareness.

- Velodyne Lidar and Luminar Technologies are notable for their partnerships with OEMs and Tier 1 suppliers, providing high-resolution LiDAR sensors and fusion software tailored for highway and urban autonomous driving.

- Startups such as Ainstein and Oxbotica are gaining traction by offering flexible, sensor-agnostic fusion frameworks that can be adapted to a variety of vehicle platforms and operational design domains.

Strategic collaborations are a hallmark of the sector, with automakers like Toyota Motor Corporation and Volkswagen AG investing in joint ventures and pilot programs to accelerate the deployment of sensor fusion-enabled autonomous navigation. The competitive environment is further intensified by the entry of Chinese technology firms such as Huawei Technologies and BYD Company, which are leveraging domestic market scale and government support to advance sensor fusion capabilities.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for sensor fusion in autonomous navigation systems is poised for robust growth in 2025, driven by accelerating adoption of advanced driver-assistance systems (ADAS), increasing investments in autonomous vehicles, and the proliferation of smart mobility solutions. According to projections by MarketsandMarkets, the global sensor fusion market—of which autonomous navigation is a key segment—is expected to achieve a compound annual growth rate (CAGR) of approximately 19% from 2025 through 2030. This growth is underpinned by the rising integration of multiple sensor modalities (such as LiDAR, radar, cameras, and ultrasonic sensors) to enhance perception, localization, and decision-making capabilities in autonomous vehicles.

Revenue forecasts for 2025 indicate that the sensor fusion market for autonomous navigation could surpass $3.5 billion, with North America and Asia-Pacific leading in both adoption and technological innovation. The automotive sector remains the dominant end-user, but significant traction is also observed in robotics, drones, and industrial automation. By 2030, the market is projected to reach over $8 billion in annual revenue, reflecting the increasing deployment of Level 3 and above autonomous vehicles and the expansion of smart city infrastructure initiatives worldwide (International Data Corporation (IDC)).

In terms of volume, the number of sensor fusion units deployed in autonomous navigation systems is expected to grow exponentially. Industry estimates suggest that shipments could exceed 50 million units globally in 2025, with automotive OEMs such as Tesla, Toyota, and Volkswagen AG ramping up production of vehicles equipped with advanced sensor fusion platforms. The proliferation of cost-effective, high-performance sensors and the evolution of edge computing are further catalyzing this volume growth.

- CAGR (2025–2030): ~19%

- 2025 Revenue: $3.5 billion+

- 2030 Revenue Projection: $8 billion+

- 2025 Volume: 50 million+ units shipped

Overall, the sensor fusion market for autonomous navigation systems in 2025 is characterized by rapid technological advancements, expanding application scope, and strong demand from both established automotive players and emerging mobility startups (Gartner).

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for sensor fusion in autonomous navigation systems is experiencing robust growth, with regional dynamics shaped by technological maturity, regulatory frameworks, and automotive industry investments. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for sensor fusion adoption.

North America remains a leader in sensor fusion innovation, driven by the presence of major autonomous vehicle developers and a supportive regulatory environment. The United States, in particular, benefits from significant R&D investments by companies such as NVIDIA and Tesla, as well as collaborations with technology firms and academic institutions. The region’s focus on safety and performance is accelerating the integration of advanced sensor fusion algorithms, combining LiDAR, radar, cameras, and ultrasonic sensors for robust perception and decision-making. According to IDC, North America is expected to account for over 35% of global sensor fusion revenues in 2025.

Europe is characterized by stringent safety regulations and a strong emphasis on standardization, which is fostering the adoption of sensor fusion technologies in both passenger and commercial vehicles. Leading automotive OEMs such as Bosch Mobility and Continental AG are investing heavily in sensor fusion R&D to meet Euro NCAP requirements and support the rollout of Level 3 and Level 4 autonomous systems. The European Union’s push for smart mobility and connected infrastructure is further catalyzing market growth, with Statista projecting a CAGR of 18% for sensor fusion solutions in the region through 2025.

- Asia-Pacific is emerging as the fastest-growing market, propelled by rapid urbanization, government initiatives, and the expansion of local automotive giants such as Toyota and Honda. China, Japan, and South Korea are at the forefront, with government-backed pilot projects and smart city deployments accelerating sensor fusion adoption. According to Mordor Intelligence, Asia-Pacific is expected to surpass Europe in market share by 2025, driven by high-volume vehicle production and increasing demand for advanced driver-assistance systems (ADAS).

- Rest of World (RoW) markets, including Latin America and the Middle East, are in earlier stages of adoption. Growth is primarily driven by premium vehicle imports and pilot programs in select urban centers. However, limited infrastructure and regulatory support remain challenges for widespread sensor fusion deployment in these regions.

Overall, regional market dynamics in 2025 reflect a convergence of technological innovation, regulatory momentum, and industry collaboration, positioning sensor fusion as a critical enabler for the next generation of autonomous navigation systems worldwide.

Challenges, Risks, and Emerging Opportunities

Sensor fusion is a cornerstone technology for autonomous navigation systems, enabling vehicles and robots to interpret complex environments by integrating data from multiple sensor modalities such as LiDAR, radar, cameras, and ultrasonic sensors. As the market for autonomous vehicles and robotics accelerates, the landscape in 2025 is shaped by a dynamic interplay of challenges, risks, and emerging opportunities.

Challenges and Risks

- Data Synchronization and Latency: Achieving real-time, low-latency fusion of heterogeneous sensor data remains a technical hurdle. Discrepancies in sensor refresh rates and data formats can lead to misalignment, impacting decision-making accuracy and safety.

- Environmental Robustness: Sensors are variably susceptible to adverse weather, lighting, and environmental conditions. For example, cameras struggle in low light, while LiDAR performance can degrade in heavy rain or fog, complicating reliable fusion strategies.

- Cybersecurity Threats: As sensor fusion systems become more interconnected, they present a larger attack surface for cyber threats. Compromised sensor data can lead to erroneous navigation decisions, posing significant safety risks (National Highway Traffic Safety Administration).

- Cost and Scalability: High-performance sensor suites and the computational resources required for advanced fusion algorithms drive up system costs, challenging widespread adoption, especially in cost-sensitive markets (International Data Corporation (IDC)).

- Standardization and Interoperability: The lack of industry-wide standards for sensor interfaces and data formats hinders seamless integration and scalability across platforms (SAE International).

Emerging Opportunities

- AI-Driven Fusion Algorithms: Advances in machine learning and deep neural networks are enabling more sophisticated sensor fusion, improving perception accuracy and adaptability in complex scenarios (NVIDIA).

- Edge Computing Integration: The deployment of edge computing architectures is reducing latency and bandwidth requirements, allowing for faster, on-device sensor data processing and decision-making (Intel Corporation).

- Cost Reduction through Innovation: Ongoing innovation in sensor manufacturing and integration is driving down costs, making advanced sensor fusion accessible to a broader range of applications, including lower-tier vehicles and industrial robots (Bosch Mobility).

- Regulatory and Safety Frameworks: The development of clearer regulatory guidelines and safety standards is fostering industry confidence and accelerating commercial deployment (International Organization for Standardization (ISO)).

In summary, while sensor fusion for autonomous navigation faces significant technical and operational challenges in 2025, rapid advancements in AI, edge computing, and regulatory clarity are unlocking new opportunities for safer, more reliable, and scalable autonomous systems.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for sensor fusion in autonomous navigation systems is shaped by rapid technological advancements, evolving regulatory frameworks, and increasing commercial adoption across automotive, robotics, and industrial sectors. As we approach 2025, several strategic recommendations and investment insights emerge for stakeholders seeking to capitalize on this dynamic market.

Strategic Recommendations:

- Prioritize Multi-Sensor Integration: Companies should invest in platforms that seamlessly integrate data from LiDAR, radar, cameras, and ultrasonic sensors. This approach enhances reliability and safety, addressing the limitations of individual sensor modalities. Leading automotive OEMs, such as Tesla and Toyota Motor Corporation, are already advancing multi-sensor fusion architectures to improve perception and decision-making in autonomous vehicles.

- Leverage AI and Edge Computing: The adoption of AI-driven sensor fusion algorithms and edge computing capabilities is critical for real-time data processing and low-latency decision-making. Investment in AI chipsets and software platforms, as seen with NVIDIA’s DRIVE platform, will be essential for maintaining a competitive edge.

- Focus on Functional Safety and Cybersecurity: As sensor fusion systems become more complex, ensuring functional safety (ISO 26262 compliance) and robust cybersecurity measures will be paramount. Collaborations with cybersecurity firms and compliance with evolving standards will mitigate operational risks and build trust with regulators and consumers.

- Expand into Non-Automotive Verticals: While automotive remains the largest market, sensor fusion is gaining traction in drones, industrial automation, and smart infrastructure. Diversifying product portfolios to address these sectors can unlock new revenue streams, as highlighted by Bosch and Honeywell’s expansion into industrial and logistics applications.

Investment Insights:

- Market Growth: The global sensor fusion market for autonomous navigation is projected to grow at a CAGR of over 20% through 2025, driven by regulatory pushes for advanced driver-assistance systems (ADAS) and full autonomy (MarketsandMarkets).

- M&A and Partnerships: Strategic acquisitions and partnerships—such as Intel’s acquisition of Mobileye—are expected to accelerate, consolidating expertise and expanding technology portfolios.

- Venture Capital Activity: Startups specializing in sensor fusion software and AI are attracting significant venture capital, with a focus on scalable, hardware-agnostic solutions (CB Insights).

In summary, stakeholders should prioritize technological innovation, cross-sector expansion, and strategic collaborations to capture value in the evolving sensor fusion landscape for autonomous navigation by 2025.

Sources & References

- IDC

- NVIDIA

- Bosch Mobility

- Mobileye

- Qualcomm

- Toyota

- dSPACE

- Velodyne Lidar

- Luminar Technologies

- Ainstein

- Oxbotica

- Volkswagen AG

- Huawei Technologies

- BYD Company

- MarketsandMarkets

- Statista

- Toyota

- Mordor Intelligence

- International Organization for Standardization (ISO)

- Bosch

- Honeywell